Navigating Market Volatility

Background.

The world economy operates within an increasingly volatile and interconnected global environment, where macroeconomic trends, geopolitical tensions, and technological advances have far-reaching impacts on financial markets. Events such as trade disruptions, changing consumer preferences, regulatory shifts, and natural disasters can all spark unpredictability, making it difficult for businesses to maintain stability and growth. The complexity of navigating these global uncertainties demands a robust understanding of the forces at play and how they intersect across different sectors.

For businesses operating at the highest levels, understanding market volatility and economic cycles is crucial to crafting strategies that sustain long-term competitiveness. The ability to manage risk, leverage opportunities, and pivot when necessary is what separates thriving organizations from those that merely survive. Senior leaders must possess the acumen to foresee and mitigate the effects of economic downturns while optimizing during periods of growth. Moreover, understanding how to manage risk within globalized contexts can foster resilience, agility, and sustained success in competitive markets.

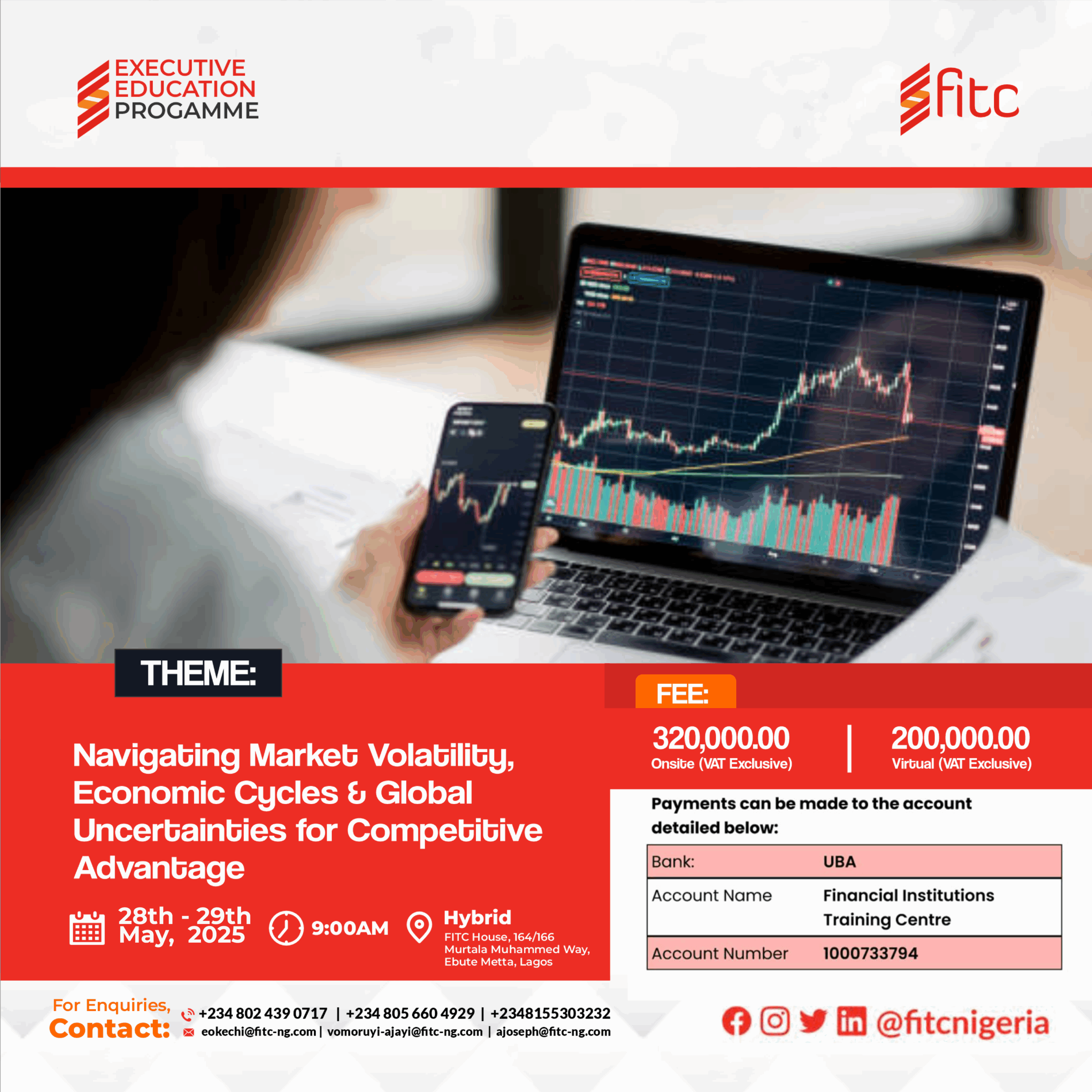

Therefore, it is against this background that FITC is organizing a 2-day programme titled, Navigating Market Volatility, Economic Cycles & Global Uncertainties for Competitive Advantage. It is specially designed to provide leaders with critical insights, practical frameworks, and strategies needed to navigate market volatility and economic cycles. With the ever-evolving landscape, this programme offers an essential intervention to equip top leaders with the tools and knowledge to lead with foresight and strategic clarity, ensuring that organizations stay ahead of the curve and drive sustainable success.

Target Audience

- This programme is specifically crafted for C-suite executives, senior management teams, and business leaders from diverse industries who are responsible for strategic decision-making. It is ideal for CEOs, CFOs, COOs, and other top-tier executives who are directly engaged in shaping the long-term direction of their organizations and navigating complex market conditions.

Learning Outcomes

At the end of this course, participants will be able to:

- Gain the ability to analyze and interpret global economic cycles and their potential impact on business performance.

- Develop a comprehensive understanding of market volatility and how to create agile business strategies that capitalize on fluctuating market conditions.

- Strengthen leadership skills to make informed decisions that foster resilience and competitive advantage during periods of economic uncertainty.

- Master advanced risk management techniques that allow for proactive responses to global disruptions and strategic challenges.

Learning Objectives

- Understand the key drivers of economic cycles and market volatility to create strategies that leverage these forces.

- Identify tools and frameworks that allow executives to respond quickly and effectively to emerging global uncertainties.

- Build resilience within organizations by implementing strategic risk management practices tailored to unpredictable market conditions.

- Develop actionable plans for maintaining competitive advantage while managing the risks posed by economic downturns and global disruptions.

Programme Focus Areas

- Understanding Global Economic Cycles and Their Impact on Business

- Examination of macroeconomic indicators and their predictive value for business cycles.

- The role of monetary and fiscal policies in influencing economic cycles.

- How inflation, interest rates, and exchange rates interact to impact business decisions.

- Identifying patterns of expansion, recession, and recovery in the global market.

- The impact of global trade dynamics on regional economies and industries.

2. Market Volatility: A Source of Risk and Opportunity

- Defining market volatility and identifying its key drivers.

- Understanding the implications of market volatility for financial planning and decision-making.

- How investor behaviour and sentiment shape market fluctuations.

- Developing an effective strategy to manage volatility within the business context.

- Building a resilient business model that thrives during market instability.

3. Risk Management in Times of Economic Uncertainty

- The importance of advanced risk management frameworks during uncertain times.

- Differentiating between short-term volatility and long-term systemic risks.

- Strategies for diversifying investments and protecting business assets.

- Leveraging technology and data analytics to improve risk forecasting and management.

- Best practices for communicating risk management strategies to stakeholders.

4. Leveraging Economic Downturns for Strategic Growth

- Understanding the concept of contrarian strategies in a down economy.

- Identifying acquisition and investment opportunities during economic slowdowns.

- How to optimize organizational resources in response to economic contraction.

- Developing a cost-cutting strategy that maintains operational efficiency without sacrificing innovation.

- Managing brand reputation and maintaining customer loyalty during tough economic times.

5. Agility and Resilience in Business Strategy

- Building a culture of agility within an organization to respond to market disruptions.

- The role of leadership in fostering organizational resilience during periods of uncertainty.

- Techniques for maintaining business continuity in times of crisis.

- How to rapidly adjust business models and offerings in response to changing market conditions.

- Case studies & Group Presentations

6. Navigating Global Geopolitical Uncertainties and Their Impact on Business

- Developing diplomatic and operational strategies to mitigate geopolitical risks.

- Understanding the connection between geopolitics and global market behaviour.

- How political risk affects international business operations and market stability.

- The role of international trade agreements and sanctions in shaping global supply chains.

- Strategies for managing global operations in regions with high political instability.