Strategic Mortgage Risk Management

Background

The global financial landscape has witnessed significant transformations driven by shifting economic conditions, regulatory advancements, and the accelerating adoption of digital innovation. Emerging markets, characterized by their growth potential and socio-economic diversity, have become critical players in the global financial ecosystem. However, these markets are inherently vulnerable to macroeconomic volatility, geopolitical uncertainties, and evolving risks, making the effective management of mortgage risks a vital priority. The interplay between high housing demand and limited financing options in these markets creates unique challenges that require robust, strategic, and adaptive approaches to risk management.

In the context of mortgage financing, emerging markets face a complex array of challenges, including inconsistent regulatory frameworks, liquidity constraints, and inadequate risk management capabilities. These challenges are compounded by external pressures such as inflationary trends, currency fluctuations, and global financial instability. Addressing these issues requires stakeholders including financial institutions, regulators, and policymakers to adopt innovative and forward-looking strategies. Effective risk management not only safeguards organizational resilience but also enhances market stability, fosters investor confidence, and drives long-term economic growth.

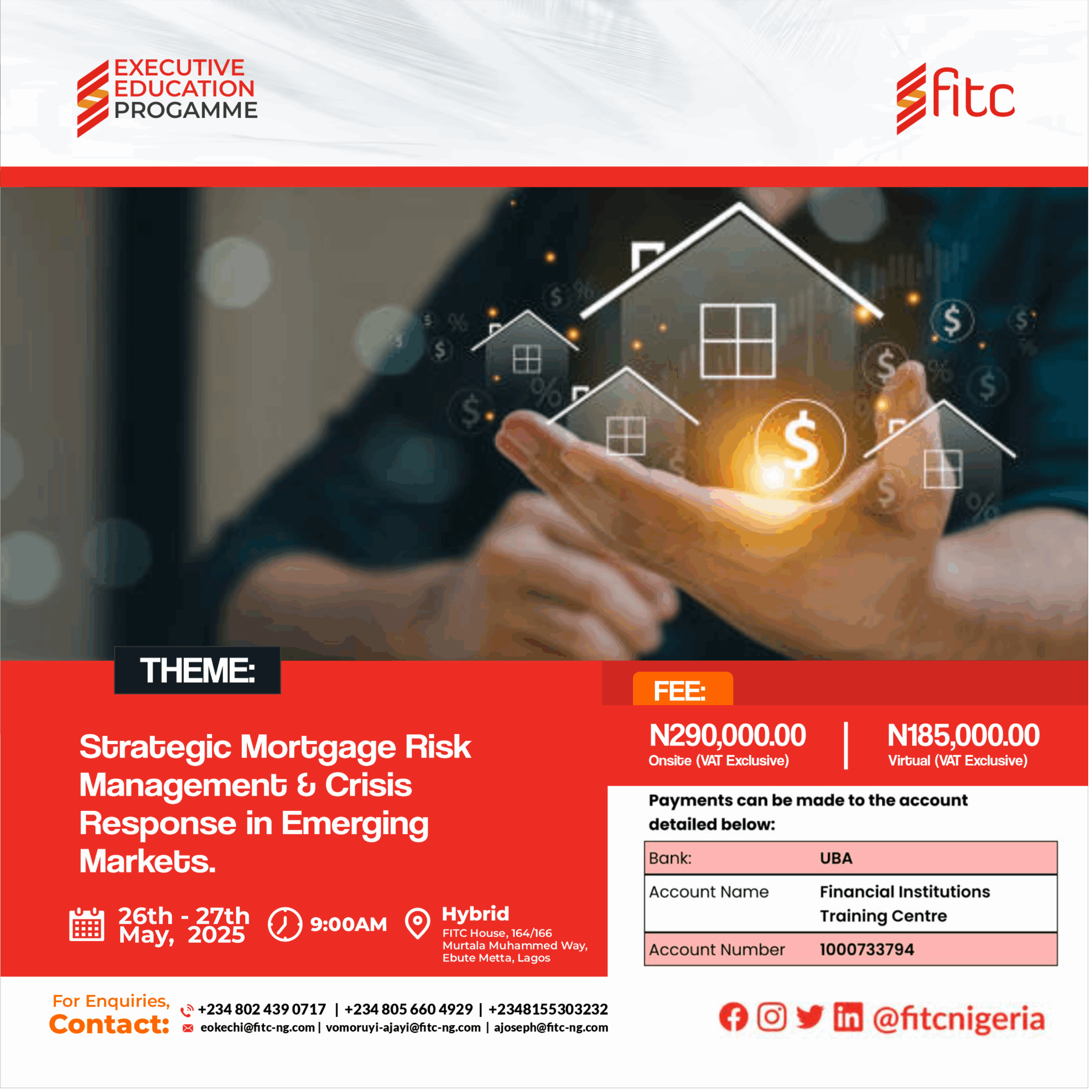

Therefore, it is against this background that FITC is organizing a 2-day Programme titled, Strategic Mortgage Risk Management & Crisis Response in Emerging Markets. This Programme, therefore, seeks to bridge the knowledge gap in strategic mortgage risk management and crisis response tailored to the realities of emerging markets. By equipping board members, executives, and senior management with cutting-edge insights, tools, and frameworks, this intervention ensures that participants are well-prepared to navigate complexities, mitigate risks, and leverage opportunities for sustainable growth.

Learning Outcomes:

- Enhance participants’ understanding of emerging mortgage market dynamics by equipping them with insights into global trends, socio-economic drivers, and the unique risks inherent to these markets.

- Strengthen participants’ ability to implement advanced risk management techniques tailored to the complexities of mortgage financing in emerging markets, enabling more resilient decision-making.

- Equip participants with crisis response strategies that ensure organizational stability, operational continuity, and market confidence during financial disruptions in mortgage sectors.

- Enable participants to leverage financial innovation and technology to improve risk oversight, foster sustainable mortgage growth, and enhance institutional competitiveness in a rapidly evolving global landscape.

Learning Objectives:

- Develop the capacity to analyze and interpret mortgage market trends by understanding macroeconomic and geopolitical influences specific to emerging economies.

- Build proficiency in applying advanced risk assessment tools and methodologies for identifying, evaluating, and mitigating credit, operational, and market risks in mortgage portfolios.

- Foster the ability to design and implement crisis management frameworks that address liquidity challenges, regulatory requirements, and stakeholder trust during periods of instability.

- Strengthening participants’ understanding of regulatory frameworks and governance structures to align institutional policies with global best practices in mortgage lending and risk oversight.

- Empower participants to integrate innovative financial technologies like AI, blockchain, and predictive analytics to enhance transparency, efficiency, and risk resilience in mortgage operations.

Programme Focus Areas.

- Dynamics of Emerging Mortgage Markets and Risk Profiles

- The macroeconomic and geopolitical factors shaping mortgage markets in developing economies.

- The structural vulnerabilities of emerging markets to global financial and environmental disruptions.

- The interplay between housing deficits, urbanization trends, and mortgage accessibility.

- The role of global investors and their influence on mortgage market stability.

- Socio-economic implications of underdeveloped mortgage financing systems.

- Governance Frameworks and Risk Oversight in Mortgage Lending

- The significance of strong governance structures in ensuring risk mitigation and market stability.

- Global best practices for aligning governance frameworks with mortgage operations.

- Regulatory compliance and its impact on mortgage governance effectiveness.

- Enhancing board oversight capabilities to address complex mortgage risks.

- Strategies for balancing institutional transparency with competitive positioning.

- Risk Assessment Techniques for Mortgage Financing

- Quantitative and qualitative tools for identifying and measuring mortgage risks.

- The role of predictive analytics and big data in shaping risk assessment strategies.

- Stress testing methodologies to evaluate resilience under adverse market conditions.

- Approaches for mitigating credit, operational, and market risks in diverse portfolios.

- The integration of environmental and social governance (ESG) considerations in risk evaluation.

- Crisis Management and Business Continuity in Mortgage Markets

- The design and execution of crisis response strategies in mortgage institutions.

- Techniques for stress testing mortgage portfolios under various economic scenarios.

- Frameworks for ensuring liquidity and operational continuity during market disruptions.

- Best practices for rebuilding trust and financial stability post-crisis.

- Developing a culture of preparedness within mortgage institutions.

- Financial Innovation and Technology in Mortgage Risk Management

- The transformative impact of digital tools such as blockchain and AI on mortgage operations.

- Leveraging fintech solutions for enhanced transparency and efficiency in lending.

- The integration of data analytics for real-time risk monitoring and decision-making.

- Navigating cybersecurity risks and data privacy challenges in mortgage technology adoption.

- Regulatory implications and governance concerns of technological innovation in housing finance.

- Regulatory Oversight and Policy Development for Sustainable Mortgage Markets

- Comparative analysis of global regulatory frameworks governing mortgage markets.

- Policies fostering housing finance inclusion in underserved and vulnerable demographics.

- The role of public-private partnerships in promoting affordable housing finance.

- Addressing policy gaps to support sustainable and resilient mortgage markets.

- Mechanisms for adapting regulatory frameworks to evolving market dynamics.